Indian arms strike richer valuations than their global parents

Oct 6, 2025

Synopsis

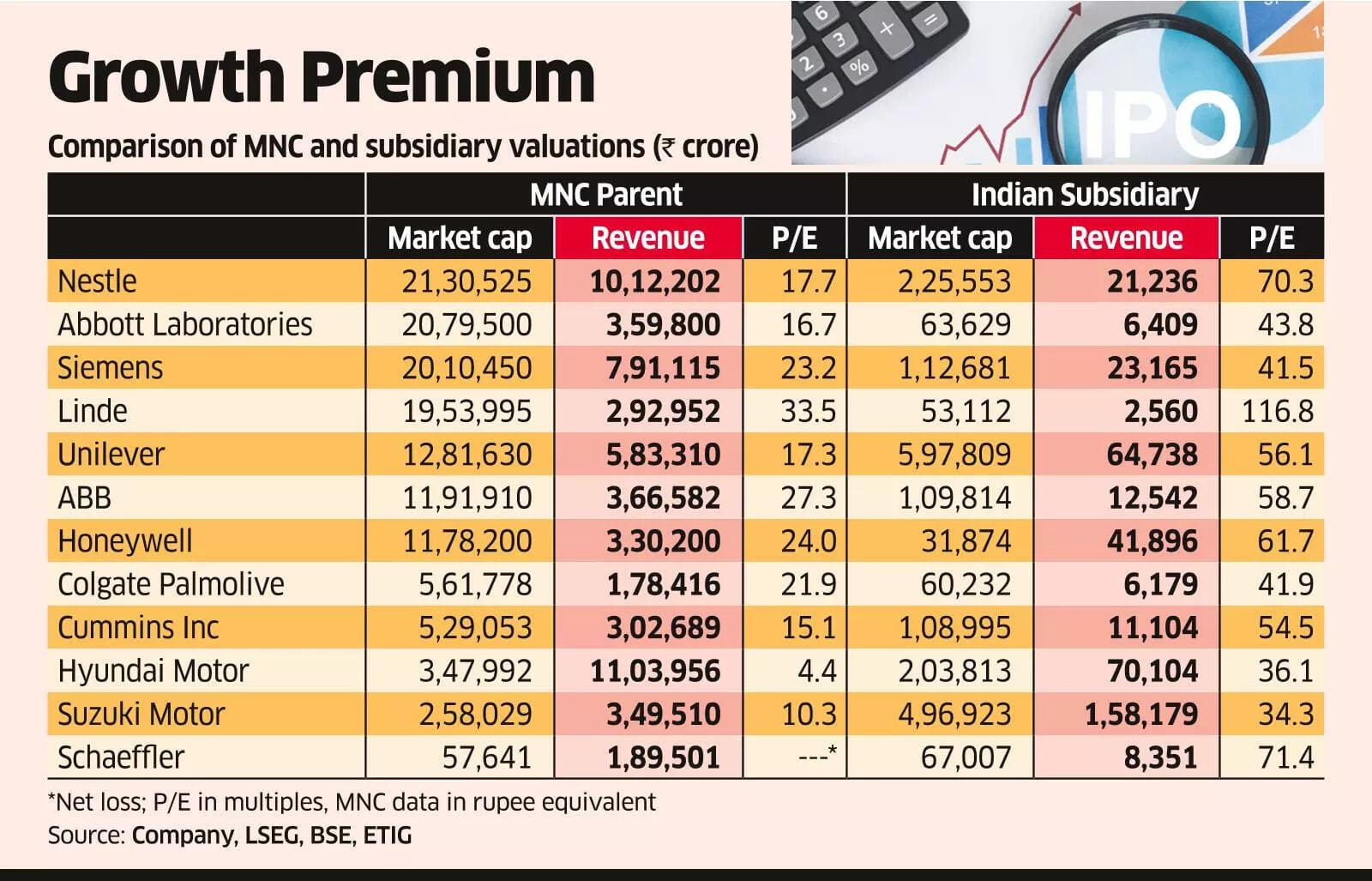

Indian subsidiaries of multinational corporations frequently command significantly higher valuations than their parent companies, driven by investor confidence in India's rapid economic growth. LG Electronics India's IPO exemplifies this trend, with its valuation far exceeding its Korean parent despite smaller revenues. This pattern is observed across numerous sectors.

The IPO valuation of LG Electronics India has once again brought to the fore an often seen trend where the Indian subsidiary of a multinational corporation (MNC) attracts a way higher valuation than the parent. And, in most cases, this is true even when the Indian business is much smaller than the parent's operations. This reflects the conviction of investors about better prospects in India given its faster pace of economic growth.

For instance, LG's Indian arm, which clocked a revenue of ₹24,367 crore in FY25, demands a P/E of around 38 to raise ₹11,607 crore through an offer for sale. Its Korean parent, which reported a rupee equivalent revenue of around ₹82,500 crore in 2024, trades at a P/E of nearly 14. In addition, the Indian arm's market cap at ₹77,380 crore is close to the parent's market cap of ₹82,492 crore. ETIG has Identified 12 such examples, including Unilever, Suzuki Motor, Nestle, Hyundai, ABB, Colgate, Siemens, Cummins, Abbott Labs, Honeywell, Schaeffler, and Linde. In each of these cases, the Indian subsidiary notwithstanding its smaller revenue size commands a better valuation than the MNC parent.

In rare cases, the Indian company even has a higher market cap than the parent. In the given sample, Maruti Suzuki India and Schaeffler India command a higher market cap than their respective MNC parents despite having lower revenues.

In other examples, Hindustan Unilever trades at a P/E of 56 compared with 17.3 for the parent. Nestle India also commands a rich multiple of 70.3 against 17.7 for Nestle SA.

Further, capital goods companies like ABB India and Cummins India too enjoy higher P/E multiples of 59 and 55 than their parents, which are at 27 and 15, respectively.

[The Economic Times]