US audit fees that lag inflation squeeze accountants

New York, July 5, 2023

S&P 500 companies paid $5.3bn in 2022, up just 3.2% as they held line on costs

Top US companies managed to hold increases in audit fees below the rate of inflation last year, adding to the squeeze on large accounting firms whose consulting arms have slowed down.

The total fee haul from companies in the S&P 500 index was $5.3bn for audits of the 2022 financial year, according to data from Ideagen Audit Analytics, just 3.2 per cent more than in 2021.

That compared to a 6.5 per cent headline inflation rate in the US, and defied predictions that fees could rise to accommodate higher salaries in a profession where qualified accountants are in short supply.

Executives and researchers cite multiyear contracts that have locked auditors into lower fees and pushback from clients at a time when companies are also wrestling with rising costs.

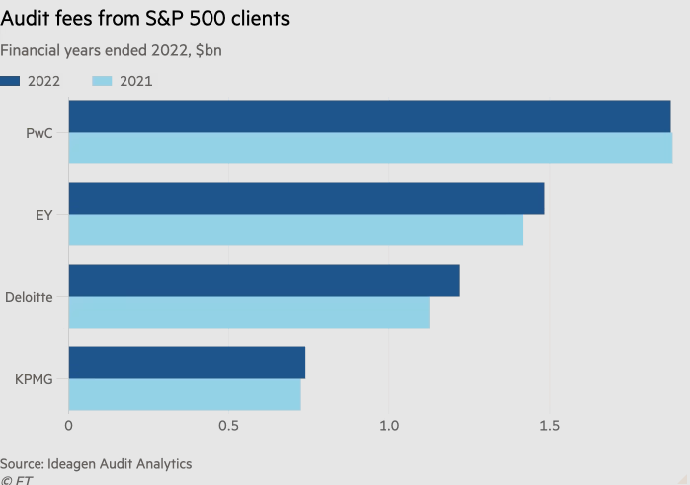

PwC, which makes the largest total of audit fees from S&P 500 clients among the Big Four firms, brought in $1.9bn in 2022, according to Audit Analytics, no more than the previous year.

Deloitte, which won T-Mobile US as a client from PwC midway through the year, increased its total by 8 per cent to $1.2bn, pulling closer to EY, which audits the largest number of S&P 500 companies and brought in $1.5bn, 5 per cent more than in 2021. KPMG’s fee haul was $739mn, up a little less than 2 per cent.

Audit fees have now fallen in real terms for three years. They fell for the average US company in absolute terms in 2020 when the pandemic hit, and the benefits to the Big Four of a small rebound in 2021 were wiped out by soaring inflation, according to Audit Analytics data.

Dillon Papenfuss, director of research at Financial Executives International (FEI), which represents chief financial officers and corporate treasurers, said audit firms would likely push for shorter contracts in the future, so they can more quickly pass on cost increases to clients. Changing audit firm on a regular basis is not mandated in the US, and the complexity of switching firm gives the incumbent a strong negotiating hand.

But IT improvements have also had an effect on fee negotiations, Papenfuss said. Companies have digitised more of their finance functions, so can argue external auditors do not need to do as much work to check the accounts, while audit firms, too, have improved their technology and companies have pushed for a share of the efficiency gains, he said.

“Companies view audit fees as a compliance cost, rather than a value-add,” said Jeffrey Johanns, a former Big Four audit partner who teaches accounting at the University of Texas at Austin.

Inflation and threats of recession have led companies to focus more heavily on costs in the past year, and executives have been putting significant pressure on all kinds of professional fees.

Consulting firms have borne the brunt, as clients rethink the value of projects, pausing or even axeing significant amounts of work.

Deloitte, EY and KPMG have all announced staff cuts in the US this year, following a slowdown in parts of their consulting arms, and KPMG last week announced a second round of lay-offs that would extend into the audit side of the business.

Audit fees are disclosed in US companies’ proxy statements ahead of their annual shareholder meetings, which have occurred in the past two months at most S&P 500 companies. The average masks significant increases and decreases at some companies, which can reflect changes to the scope of the audit based on M&A activity or other factors.

Companies and auditors alike had expected 2022 could mark the beginnings of a shift in fees. Audit Analytics said in its annual fee study last October that auditors might need to increase rates to reflect the extra complexity of new accounting rules. FEI said in November that “demand for qualified accounting and finance talent continues to increase, as do increases in wages across the accounting profession . . . and we anticipate they will be a key driver in the changes in audit fees in future periods”.

[The Financial Times]